As the year draws to a close, property market experts and analysts can breathe a sigh of relief as the market outcome was much better than expected, despite facing several challenging factors this year.

Though house price growth was slower than initially expected, the market weathered the storm and time to sell returned to pre-pandemic levels.

Rental markets continued to deliver high yields for property investors in 2023 as rents went up by over a third above inflation.

What Happened With House Prices In 2023?

The housing market has been on the road to recovery this year, gaining momentum as global economies have steadied.

- Starting the year with sales at their lowest levels since the pandemic, the market saw a significant bounce back, reaching peak 2019 levels by June 2023.

- Despite several slower months, house prices climbed significantly at the start of Q4 2023.

- Cash buyers and Investors formed the second largest type of buyers in 2023, behind first-time buyers. As a result, they have decreased the gap from 1 in 5 sales to 1 in 3 YTD.

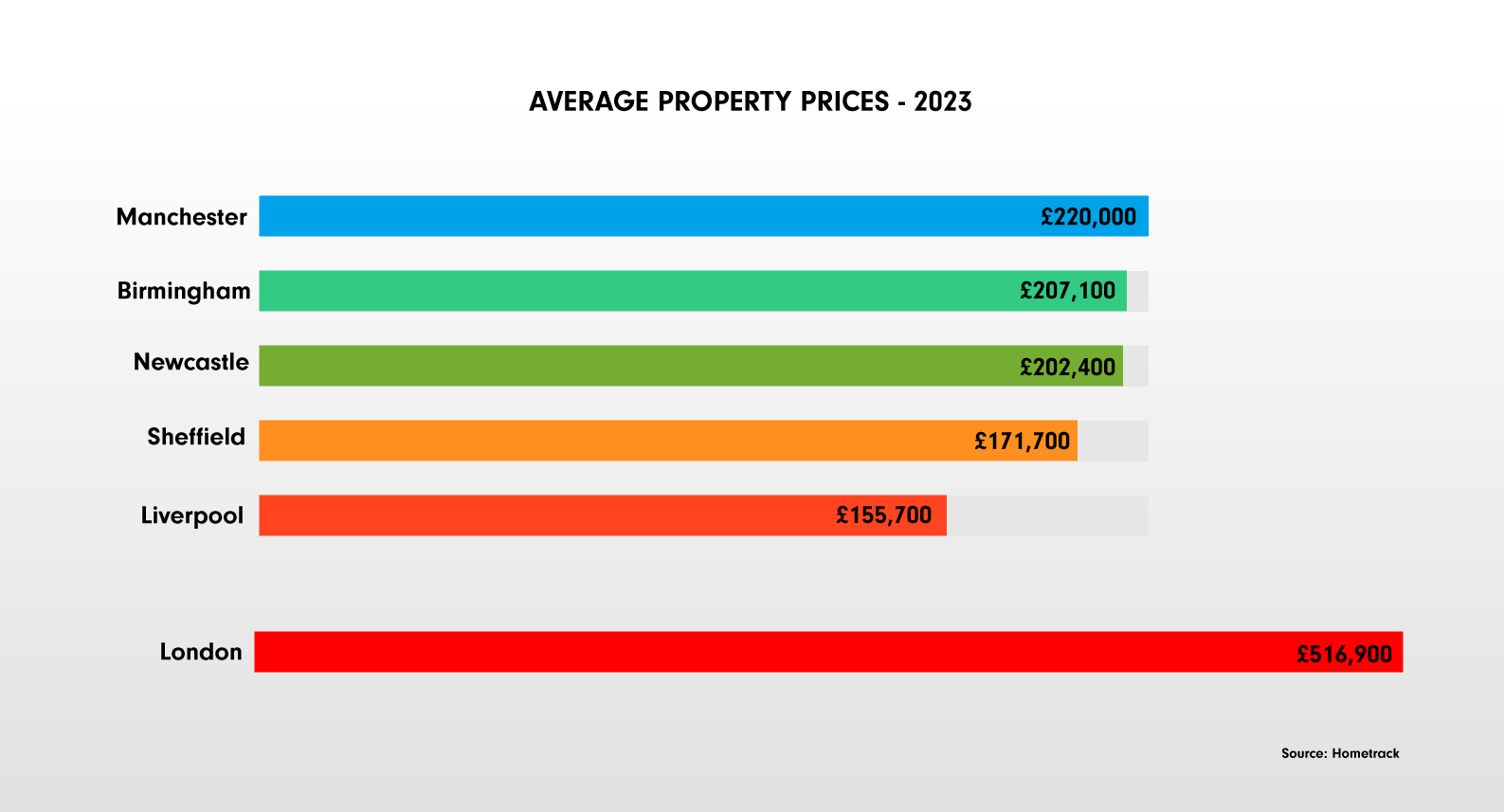

Average Property Prices – 2023 (Hometrack 2023)

- Birmingham – £207,100

- Liverpool – £155,700

- Manchester – £220,000

- Newcastle – £202,400

- Sheffield – £171,700

- London – £516,900

House Price Predictions For 2024?

Zoopla’s November House Price Index suggests that house prices will dip at the start of 2024 despite market activity expected to display a strong rebound.

The fall reflects a challenging economy. This is where investors can act on their long-term plan and buy now while the prices are low, benefit from high tenant demand, and consider selling in the future when the prices climb.

How has Rental Growth Impacted The UK Property Market?

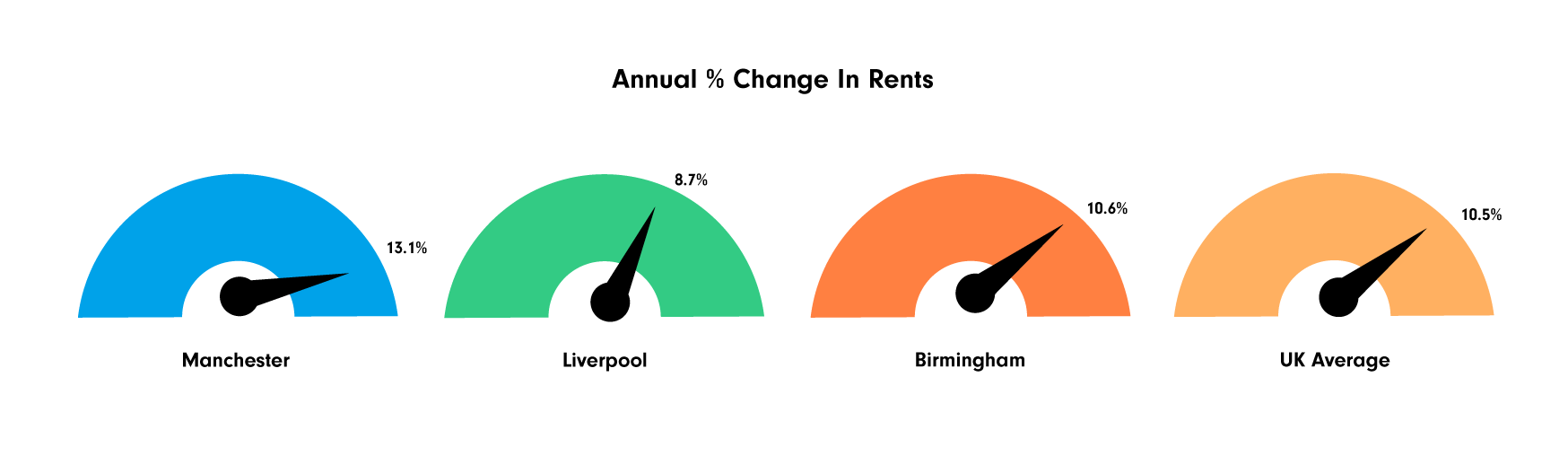

It’s been another robust year for rental returns as many cities reached a 5-year high, with larger growth in the North of England.

Rental growth in the North far outweighed the South. The swift decline of Southern markets such as Exeter and Brighton can be attributed to business growth and employment opportunities in the North.

- Manchester – 13.1% Annual % change in Rents

- Liverpool – 8.7% Annual % change in Rents

- Birmingham – 10.6% Annual % change in Rents

- UK Average – 10.5% Annual % change in Rents

Here are some other key take away points from the Rental market

- Rental trends in the North West experienced a 11.6% rise through the middle of 2023, the highest region outside of London.

- Rents for new lettings properties are up 10.5% in the past 12 months (Hometrack)

- Rental inflation has been in double digits for 18 months

- In 2023, Rents outpaced earnings in terms of growth

Rental Growth Predictions For 2024

Zoopla predicts that rents for new lettings will continue to grow due to continued undersupply of available properties and high mortgage rates.

This is welcome news to investors who can use short-lets to secure the maximum available rates for the highest-performing cities in the UK, such as Manchester, Liverpool and Birmingham.

What have property investors been doing in 2023?

In 2023, Home sales returned to pre-pandemic levels taking an average of 34 days to sell. In the North of England homes sold faster at an average of 30 days. However, key cities were even quicker beating the 5-year average reported by Zoopla.

Properties In Liverpool – 17 Days

Properties In Manchester – 21 Days

Properties In Salford – 23 Days

Properties In Newcastle Upon Tyne – 25 Days

Properties In Stoke On Trent – 25 Days

These buying patterns have been reflected by buy to let property investors over the last 12 months and we’ve seen our schemes in Liverpool City Centre and Greater Manchester make up the majority of sales in 2023.

Types of Property Investments To Consider – Based On 2023 Market Trends.

With the 2023 figures putting the rental market in a prime position ahead of the new year, Buy To Let properties remain the best option for investors looking for high returns and consistent income.

Throughout the year, we’ve seen the traditional off-plan buy to lets contribute towards the bulk of client portfolios with a strong emphasis on the North. In addition, the rise of HMOs (Houses of Multiple Occupancy) has opened the market to a new type of investor, and several of the schemes sold through Alesco have now been completed and are performing well in regard to rental returns and tenant interest.

How to invest in UK property in 2024

Using this year’s data as a roadmap can provide a great insight into your property investment options for the year ahead. Now is the time to Identify the right opportunities in the UK property market. Whether this is your first time investing or you’re a seasoned property investor, we can help you with expert market insight and access to one of the UK’s best property investment portfolios.

Get in touch with us for more information or to make an enquiry

Written by: Perry Jax

Experienced Marketing professional working in the real estate investments sector.