Reviewed by: Ben Whitaker (Senior Investment Consultant), James Needham (Managing Director)

Manchester is widely hailed as the fastest-growing city in the UK. With exceptional increases in population, industry relocation and tourism popularity, this northern hotspot has been the centre of major public and private investment. In particular, property investors are turning their attention and resources to make the most of Manchester’s growth.

A key factor in this interest is the booming rental yields available through buy-to-let property. To get a deeper dive on why this figure is important, take a look at our article ‘What is a Good Rental Yield?‘.

In this article, we’ll take you through what’s making Manchester a hotspot for property investment, the capital growth that you can expect to find, and the hidden gems within the city that investors are currently targeting.

Manchester Rental Yield Guide

1 – The Big Picture

Manchester has asserted itself as one of the best places for property investment in the UK. Here’s why.

Key Investment Drivers in Manchester

- Economic Growth & Regeneration: With the development of Manchester’s business sector, several major institutions such as ITV, The BBC and Google have relocated or set up major sites in the city. Projects such as MediaCityUK have been crucial in these moves, creating thousands of jobs and attracting a fleet of young professionals into the area, all of whom need quality accommodation.

- Infrastructure & Connectivity: Manchester’s transport links have also been subject to heavy investment. This has led to a connected city, not only within Greater Manchester but also to the rest of the country, allowing easier access for travellers as well as commuters.

- Capital Growth Potential: Over the last 5 years, the city has excelled in comparison to the south regarding not only rental yield increase, but also property price growth. For example, the average price for a house has risen by an astounding 7.6% year-on-year, with this figure forecasted to increase further over the next decade.

“Manchester isn’t just a city we recommend. It’s a market we actively analyse and engage with. The fundamentals for strong rental demand and sustainable yields are robust.”

Ben Whitaker, Senior Investment Consultant

For a broader overview of Manchester’s investment landscape, see our dedicated Manchester property investment page.

2 – Manchester Rental Yields: What Do the Numbers Say?

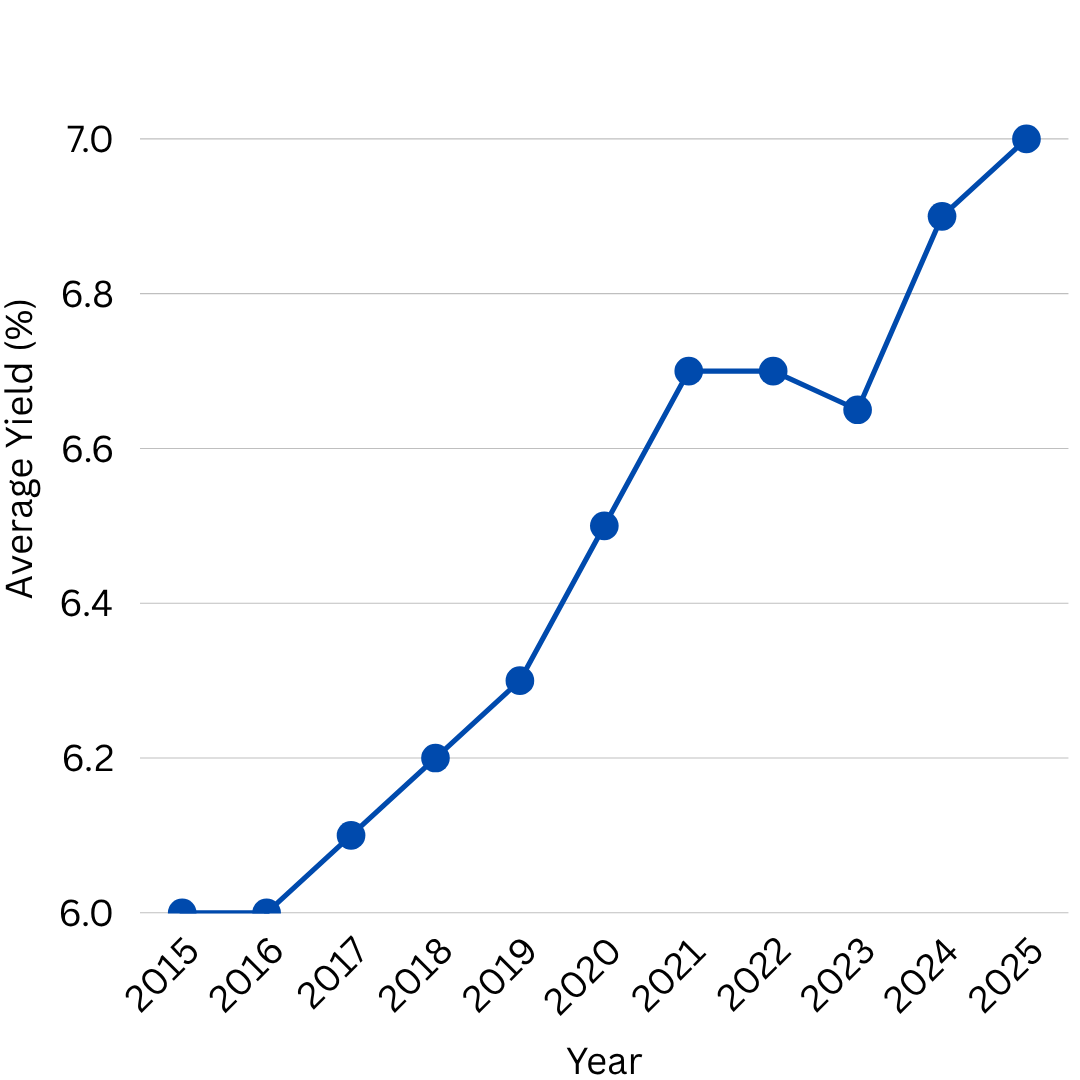

In the current market, investors would expect yields in Manchester from anywhere between 6% and 9%. This variation is in line with the diverse districts, postcodes, property types and regeneration projects within the Greater Manchester area.

Higher rental yield areas allow you to make stronger returns on your property faster than lower percentages. However, strong capital growth can still be achieved over time regardless of yield percentage.

The strong yield growth over time is indicative of the exponential shift of industry and investment towards Manchester. This combination has drawn a wide range of professionals and leisure visitors to the city, increasing both population and economic performance.

These positive signs have created a wide margin for capital growth and a timely opportunity to enter the market before property prices rise to levels seen in the south of the country.

“Compared to London, where yields might hover around 3-4%, Manchester often presents a more attractive income proposition from the outset, without necessarily sacrificing long-term growth prospects.”

Ben Whitaker, Senior Investment Consultant

3 – Manchester’s High-Yielding Hotspots & Hidden Gems

Below are some of the key areas for opportunity within the Manchester area.

- City Centre: The city centre understandably holds an almost unlimited tenant pool, supplying guaranteed yields. Furthermore, the capital growth opportunity here is very significant, as property prices here are very unlikely to let you down over long periods. However, this also comes with a higher entry point to market, which might be more challenging for budget or first-time investors.

- Salford Quays: With the rise of MediaCityUK, now hosting The BBC, ITV and is the perfect time to invest in Salford. A low barrier to entry, outstanding yield potential of 9-10% and no shortage of tenants provide this area with all the hallmarks of an excellent investment.

- Trafford: The future of this area is certainly exciting to contemporary investors. Its proximity to the city centre, MediaCityUK and Europe’s largest industrial centre make this a prime location to entrust your capital. Trafford has been proven to be more than desirable for professionals looking to live within arm’s reach of all Manchester’s key locations.

Manchester’s key locations continue to boost its reputation as one of the UK’s top investment hotspots. Compared to the South, it offers stronger rental yields and consistent capital growth, all at a much more accessible entry point. This makes it a great option for investors looking to get strong returns without the higher upfront costs seen elsewhere.

“Our focus is always on data-backed opportunities. We look beyond the headlines to find areas in Manchester that offer sustainable yields and align with our clients’ long-term investment goals. It’s about a balanced approach.”

James Needham, Managing Director

It’s not just about the city, but the specific location within the city: While popular postcodes attract attention, savvy investors often look for areas with strong fundamentals that are perhaps not yet at their peak. We’ve recently written a piece covering Manchester’s hidden gems in expert detail, if you’d like to learn more.

4 – What Else to Consider in Manchester

Despite the area’s numerous buy-to-let hotspots, there are still various factors for you to consider as a serious investor. For example, maintenance, council and management costs all still need to be thought of when calculating potential returns on your investment.

Furthermore, potential void periods also need to be considered, with most investors targeting areas with consistent demand or accommodation shortages.

Finally, appreciation and capital growth should be very high on any investor’s priority list, to make a potential exit give you a serious return on your initial purchase.

“A high gross yield looks great on paper, but we help investors understand the net return and the long-term viability of a Manchester property investment. It’s about the complete picture.”

Ben Whitaker, Senior Investment Consultant

5 – Making Manchester Work For You

In conclusion, investors are setting their sights on Manchester with very good reason. The city is boasting exceptional rental yields and capital growth, which is only due to increase alongside economic, business and leisure development throughout the area.

However, as an investor, it is crucial that you do your due diligence first, and that’s where we come in. Our expert consultants can help guide you through your purchase process, understanding your needs and presenting you with some of the most rewarding opportunities on the contemporary market.

To discuss your strategy and find properties that align with your financial goals, contact our team of property investment experts.

Written by: Harry Dowell