Tariffs, shocks and the realisation investors needed

When the US reintroduced tariffs in early 2025, it reminded investors just how reactive global equities can be. It also underscored the resilience of real estate. While volatility rippled through stock portfolios, residential property, particularly income-producing homes in durable UK markets, showed its staying power. In the broader conversation about risk and return, this matters.

The reason? Stability. Property, in general, is more stable. While luxury sectors like hotels saw hesitation, and housebuilders faced rising material costs, these challenges were largely contained. In the core of the residential market, rental demand held firm, values remained steady, and income continued to flow.

That contrast between the immediate, high-volatility reaction in stocks and the steady performance of residential property reignited the question: should you trust your money to stocks or real estate? In this article, we explore why property still stands out as the dependable choice, particularly when the wider financial climate grows unpredictable.

Stocks: High Risk, High Reward, High Anxiety?

In the pursuit of financial growth, many investors are naturally drawn to the stock market. It’s accessible, scalable, and has the potential for rapid returns. With a few clicks, you can gain exposure to global industries and enjoy the success of some of the world’s most influential companies.

But let’s not ignore the downside: volatility. Markets move fast, and the odds are not always in your favour. Whether it’s a political shift or an interest rate hike, prices react instantly. That can be hard to watch, especially if you’re relying on that capital or income. Dividends help, but they’re not set in stone. They rise, fall, or disappear altogether.

If you’re the kind of investor who values consistency and a sense of control, stocks might not give you that peace of mind.

That’s why many investors look to property when considering property or stocks. While the property market may move at a slower pace, it often delivers greater consistency, and for many people, that reliability is what matters most.

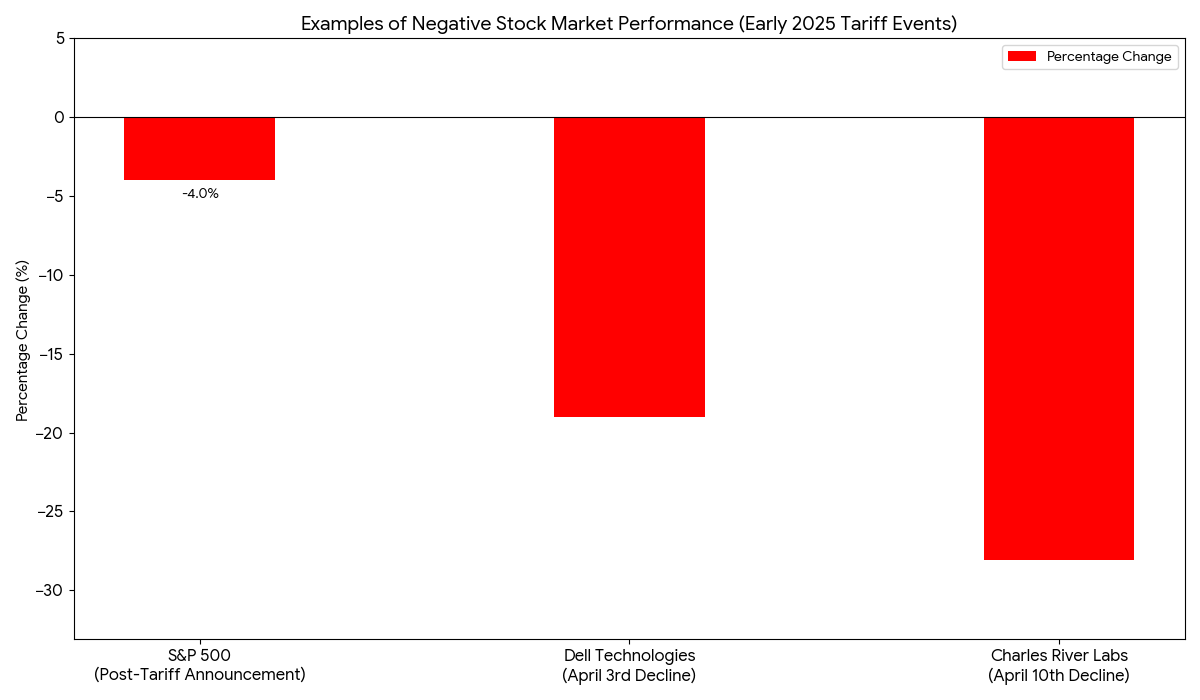

Examples of Negative Stock Market Performance (Early 2025 Tariff Events)

Recent events have highlighted the potential for significant volatility and negative impacts within the stock market, particularly in response to major economic policy shifts. The introduction of widespread US tariffs in early 2025, for example, triggered sharp declines across various sectors and individual stocks as investor confidence was shaken.

- S&P 500 Index: Experienced a sharp single-day decline of over 4% following major US tariff announcements in early 2025, indicating broad market unease.

- Dell Technologies Stock: Plummeted 19% on April 3rd, 2025, as tech companies with global supply chains faced tariff-related pressures.

- Charles River Labs: Fell 28.1% on April 10th, 2025, after an analyst downgrade linked to concerns about potential pharmaceutical tariffs.

“Tariffs, elections, inflation data… these can wipe out 10% of your portfolio overnight. And unless you’re an expert, that’s not exactly the security most investors are seeking in 2025.”

Property: Consistent, Steady, and Predictably Profitable

Wealth isn’t built overnight but with patience, consistency, and smart decisions over time. Property fits naturally into this mindset. While it may not deliver overnight returns like high-growth stocks, its long-term stability and ability to appreciate steadily make it a foundation for generational wealth.

This is especially true with buy-to-let properties: you can expect a consistent rental income that is straightforward to track and less susceptible to market fluctuations.

What’s more, real estate is tangible — you can see it and manage it directly, which sets it apart from stocks or bonds. Furthermore, in the UK, the demand for homes often exceeds supply, leading to an increase in property values over time.

When you consider these factors, it’s clear that investing in property presents a steady and reliable opportunity for growing your wealth.

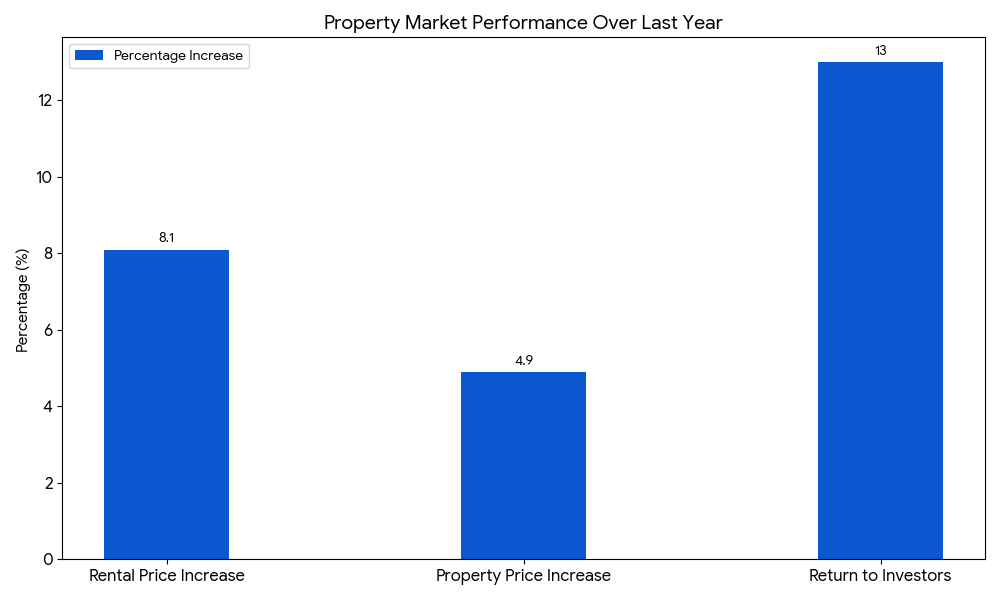

Property Market Performance Over Last Year

With the stock market facing considerable dips and uncertainty, property investment is the alternative you should consider. Commonly known as bricks and mortar, property provides two streams of return.

- Monthly Income: With a shortage of quality housing across the UK, we saw an average of 8.1% increase in rental prices over the last 12 months.

- Capital Growth: The UK property market continues to perform despite economic challenges, with a price increase of 4.9% over the last year.

Alesco’s return to investors last year was 13%.

“Property isn’t just bricks and mortar. It’s inflation protection, passive income, and capital growth, all in one.”

Brokers Aren’t Just for Shares, They’re for Property Too

From London to Edinburgh, and Manchester to Hull — strategic property investing takes you places, especially the most unexpected ones.

Just like a broker helps you diversify stocks you’ve never heard of, Alesco evaluates under-the-radar property locations that outperform the usual suspects. We guide clients through the property landscape like a stockbroker navigates the markets but with a focus on areas with less risk and more predictability. Just like Hull, which is now enjoying a status as an investment hidden gem with an average Rental Yield: of 7.3%.

Our experts are also able to identify markets that have yet to emerge based on economic forecasts. Alesco will know, for example, that Universal Studios is about to invest millions of pounds in Bedford: the new home to one of the biggest entertainment parks in Europe.

And if you’re drawn to the stock market for its fast-paced, dynamic lifestyle, you’ll find that same excitement in property investment — minus the volatility. It’s not about estate agents and showings; it’s about strategy, market insight, and smart decision-making. Just like trading, but with more stability and long-term gain.

“We don’t just find any property. We hunt for the right yield, in the right postcode, for the right person. That might mean Preston, not London.”

Property and stocks compared

If you want your money to work harder for you while you focus on other endeavours, property investment remains one of the most reliable vehicles in 2025.

| Factor | Property Investment | Stocks & Shares |

| Stability | High: Less reactive to global shocks | Low: Highly sensitive to news & geopolitics |

| Passive Income | Monthly rental income | Dividends (variable, not guaranteed) |

| Capital Growth | Steady, tied to location & regeneration | High potential, but volatile |

| Tangibility | Physical asset you can see, manage, and influence. You understand its value because it exists in your world, not just on a screen. | Abstract asset, controlled by complex market forces and the knock-on effects that come with it. |

| Entry Knowledge Required | Low: Alesco guides you | Medium to high: DIY or advisor needed |

| Diversification Potential | High: invest in multiple regions/postcodes | High: can diversify by sector, geography |

Property Investment Needs a Strategy: Alesco Works With You

Most people understand the value of investing in property to generate rental income. But knowing you should invest is only the start — what matters is having the right strategy. That’s where Alesco stands apart.

We don’t follow headlines. We follow yield. While others rush into crowded, overpriced markets, we focus on what drives returns: strong rental yields, future regeneration, and reliable tenant demand.

Our team takes a data-led approach to identify areas with long-term potential. These aren’t always the cities making the front pages. The best-performing opportunities are often far from the spotlight, and even further from where overseas investors are looking.

“In the past year, properties in Preston offered 7–8% yields while London hovered at 3%. One’s flashy; the other’s financially smart.”

FAQs: US Tariffs Impact On UK Property Investment

What do the Tariff changes mean for foreign investment in UK property in the short and long term?

Tariffs spark short-term interest in UK property as investors seek stability. Lower rates and strong rental demand boost appeal. However, over time, higher import costs could affect construction and pricing. Still, the UK’s solid housing demand keeps it a solid choice for long-term foreign investment.

Could the changes to Tariffs actually have a positive impact on the UK Property Market?

Yes, as global uncertainty rises, the UK, with its strong legal system, high housing demand, and limited supply — becomes a safe haven for capital. This can drive more foreign investment into UK real estate, especially in under-the-radar cities with strong yields.

Which sectors of the property industry (hotel, luxury, residential or commercial) are most exposed to tariff shocks?

Tariffs rarely shake the entire property market, but they do expose weaker spots. Luxury and hotel developments are most vulnerable, reliant on big-spending investors who may retreat in uncertain times. Housebuilders could face some pricing pressure on imported materials — but core rental markets remain strong and stable.

Are there any specific cities in the UK that could see volatility due to the global trade shift?

Yes, certain UK cities are more susceptible to volatility stemming from global trade shifts. Prime Central London (Zones 1 and 2), for instance, has experienced a slowdown due to higher borrowing costs and increased stamp duties, particularly affecting high-net-worth investors who are sensitive to global economic fluctuations.

In contrast, regional cities like Manchester, Birmingham, and Leeds have shown resilience, bolstered by diversified economies and ongoing regeneration projects.

For the concerned investor, is it better to invest in the stock market or property?

Our recommendations haven’t changed: UK property continues to be one of the most robust investment assets. Nationwide, property prices are on a steady upward trajectory, with certain markets experiencing near double-digit growth, reflecting strong and consistent demand.

Final Thoughts: In an Uncertain World, Make a Solid Investment

In 2025, the decision to invest in property or shares hinges on your financial goals and risk tolerance.

Recent events, like the return of US tariffs, have reminded us just how unpredictable the stock market can be. Shares offer the upside of rapid growth potential and liquidity, but they’re also vulnerable to sudden swings caused by factors like geopolitical tensions or economic shocks.

Property, on the other hand, has shown its characteristic stability — especially in the UK. House prices rose by 5.4% in the year to February 2025, up from 4.8% in January. That steady growth reflects a market driven by strong demand, limited supply, and a healthy rental scene.

Investing in property comes with its perks: it’s a physical asset you can see and touch, it brings in regular rental income, and it tends to appreciate over time.

While it is true that shares can play a valuable role in a balanced portfolio, property holds significant appeal for those seeking greater stability and predictability. Focus on areas with good fundamentals, like growing populations, strong job markets, and ongoing infrastructure investment and you’re more likely to weather economic ups and downs with confidence.

“Looking for high-yield UK property investment opportunities with real staying power? Let’s talk. We’ll help you find the kind of property that makes passive income feel like the smart move it really is.”

Written by: James Needham

Experienced Team Lead with a demonstrated history of working in the real estate industry.