Steering through an era of unprecedented change

From new governments reshaping policy agendas to the lingering aftershocks of the pandemic that continue to affect how we live and work, uncertainty is everywhere. On top of that, shifting US trade relations, ongoing conflicts, and supply chain disruptions add even more complexity. The old rules of investing no longer apply.

At Alesco, we see these changes as fundamental realities that call for a fresh look at traditional investment strategies. As the macroeconomic landscape evolves, investors need to adopt new, data-driven ways to assess risk and find opportunity.

In this climate of uncertainty, one question stands out: where should investors place their capital to achieve sustainable, long-term growth?

The answer is that property remains a powerful and resilient investment, but only when approached strategically. The era of broad, uniform growth is behind us, but the path forward is clear: choose wisely, act decisively, and let data guide your decisions. Property still delivers a valuable mix of steady income, capital growth, and inflation protection, all vital ingredients for success today.

The Enduring Resilience of Bricks and Mortar

Residential property has shown remarkable resilience during times of economic stress. After the 2008 financial crisis and throughout the COVID-19 pandemic, property stood firm when many other investments were more volatile.

Unlike stocks or bonds, which can fluctuate wildly in response to market news, property is grounded in a fundamental reality: people always need a place to live. This steady demand for rental homes helps keep occupancy rates and rental incomes relatively stable, even when the broader economy is unsettled.

Construction indeed faces challenges like material shortages and labour delays. But the value of existing homes and land is something different altogether. Unlike investments tied to complex, fragile global supply chains, property offers a kind of security that’s physical and real. During times of uncertainty, investors often turn to property as a “flight to safety”, seeking not just steady income and growth but also protection against inflation and market volatility.

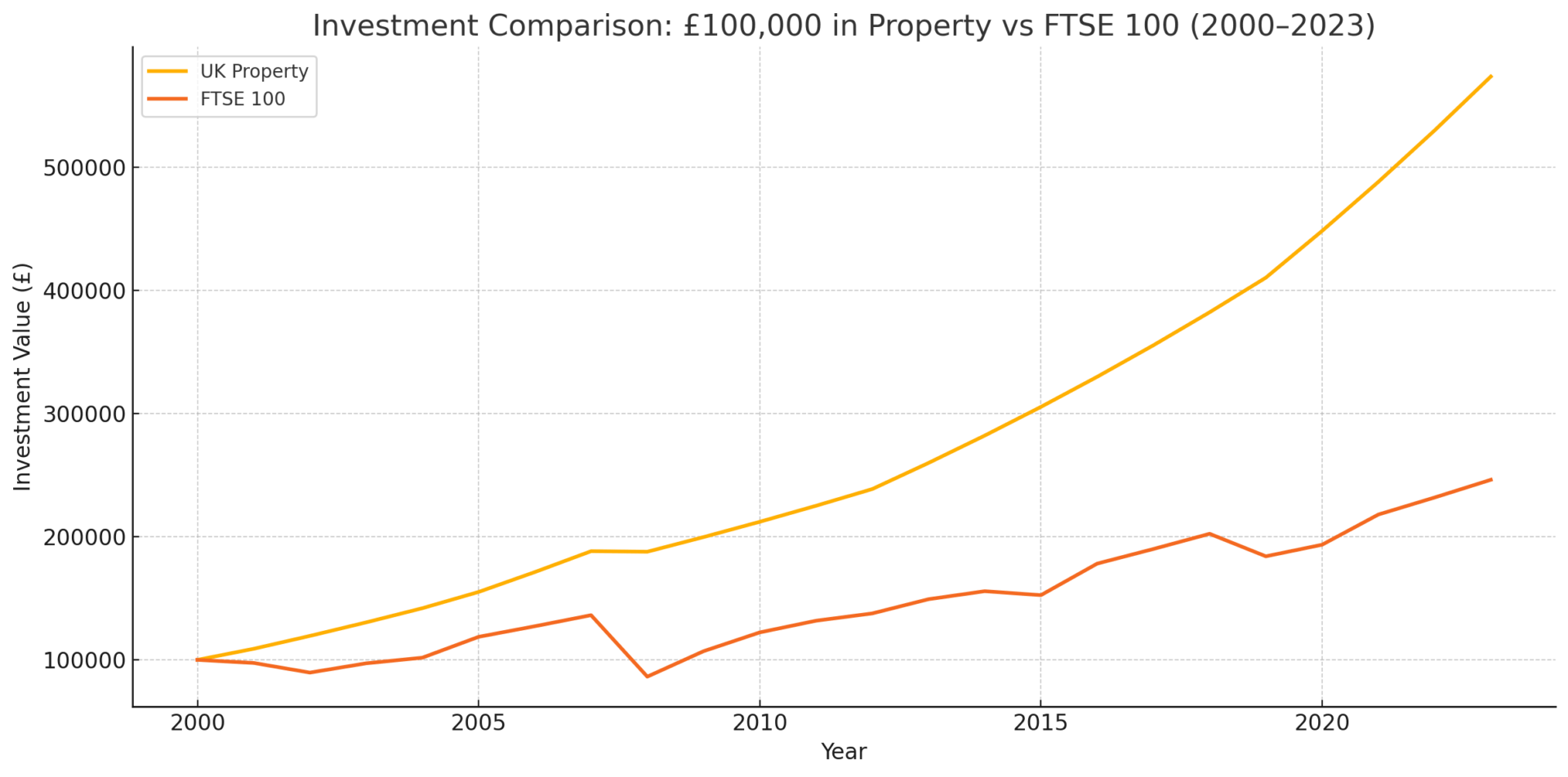

FTSE 100 Vs Property: £100,000 Investment

Here’s a simple illustration of what would have happened if you invested £100,000 in the year 2000 into:

- UK residential property, earning capital growth + 3% annual rental yield.

- FTSE 100, assuming dividend reinvestment and price growth.

This provides a “real money” comparison, showing the actual value of the investment over time.

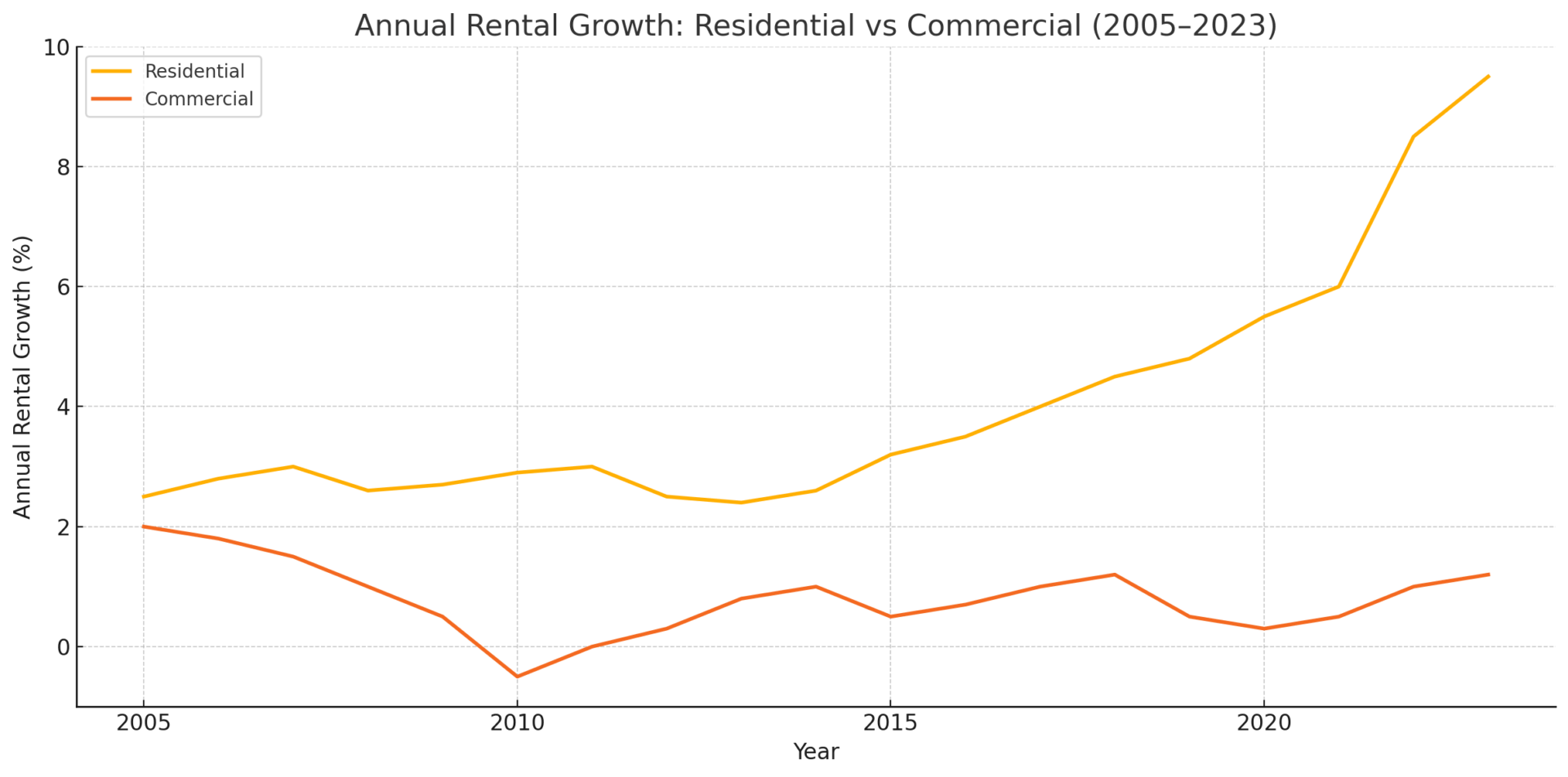

RESIDENTIAL VS COMMERCIAL: RENTAL DEMAND TRENDS

Here’s a simple comparison showing how annual rental demand has changed across two key sectors in the UK property market:

- Residential rents rose steadily from 2005, with sharp increases from 2020 onward as housing demand surged and supply remained constrained.

- Commercial rents, especially in retail and office space, remained mostly flat, reflecting shifting work patterns, economic uncertainty, and reduced occupier demand.

This highlights the growing strength of residential rental demand versus the stagnation seen in many parts of the commercial property sector.

PROPERTY INVESTMENT: WHAT TO EXPECT IN NUMBERS

Whether you’re just getting started or already investing, these are the general numbers that can shape your returns and what you might expect beyond the headlines:

| Factor | What to Know |

|---|---|

| Upfront Costs | Stamp duty, legal, sourcing fees, can be up to £4,000–£6,000 on a £100k purchase |

| Ongoing Costs | Letting, insurance, and maintenance can reduce 3% gross yield to ~2% net |

| Net Yield | 9% after costs in most managed investments |

| Capital Growth | Historically, 4–6% per year in strong locations |

| Tax | Rental income is taxable; capital gains apply on sale |

| Leverage | Mortgages can boost returns, but increase risk and complexity |

“Tariffs, elections, inflation data… these can wipe out 10% of your portfolio overnight. And unless you’re an expert, that’s not exactly the security most investors are seeking in 2025.”

Partnering for Resilient Returns

Buying a property is just the beginning. Real success comes from treating it as a long-term journey, not a quick win. Markets shift, tenant needs change, and the broader economy never stands still, so your investment strategy shouldn’t either. Staying ahead means reviewing, adjusting, and thinking long-term from day one.

Behind the Scenes of Smart Investing

At Alesco, we help our clients find the right property, in the right place, for the right reasons. That often means uncovering opportunities in markets that aren’t grabbing headlines but show strong fundamentals: growing populations, rising rental demand, and planned infrastructure.

Once a potential opportunity is identified, we dig deep. Our due diligence process is rigorous because we know small details can make a big difference. We also help navigate the ins and outs: local rules, lending options, and construction timelines, so our clients can move forward with clarity and confidence.

And it doesn’t stop at acquisition. We work with investors to structure deals for long-term performance, helping them balance income, growth, and risk. It’s all about setting things up properly and being ready to adapt when the market shifts.

Less Guesswork, More Concrete Data

Every recommendation we make is grounded in detailed research, long-term trends, and a deep understanding of the markets we operate in. While some investors chase headlines or short-term spikes, we take a different view. We focus on fundamentals: where people want to live, where infrastructure is improving, and where demand is quietly building. That’s how we help our clients find opportunities others overlook and build portfolios that stand the test of time.

With the right guidance and a clear long-term strategy, property remains one of the few asset classes that can offer both resilience and meaningful growth.

“Our philosophy is built on rigorous analysis and a deep understanding of the markets we operate in. We guide our clients towards opportunities that offer not just immediate appeal, but sustainable, long-term value, the true hallmark of a sound investment.”

FAQs for the Discerning Investor

While every investment strategy should start with a clear long-term vision, we often hear the same key questions from clients looking to deepen their understanding. Below, our Managing Director shares his perspective on three of the most common and important questions.

Q1: Is it better to invest in property or savings?

Both have their place. Savings provide essential liquidity and peace of mind, a foundation for any financial plan. But over time, inflation can erode cash’s real value. Property, on the other hand, offers the potential for income, capital growth, and inflation hedging. It’s not an either/or decision; it’s about using both tools effectively within a balanced strategy.

“Cash savings are the bedrock of financial security, providing essential liquidity. However, for meaningful wealth generation and to counteract inflation, assets like property, which are capable of producing income and appreciating, play a critical role in a forward-looking portfolio.”

Q2: Which property type is best for investment?

There’s no single right answer; it depends on your goals, risk tolerance, and capital. Residential buy-to-let, HMOs, and student accommodation all have different risk-return profiles.

Success lies in matching the asset type to your objectives and doing the due diligence: market demand, yield vs. growth potential, and local fundamentals. Our guide, What Are the Top Property Investment Types? explores this in more depth.

“The ‘optimal’ property investment is not a universal answer but one tailored to an investor’s specific objectives and circumstances. It involves a careful assessment of various property types, as detailed in our guide, alongside rigorous market analysis.”

Q3: What about common rules of thumb, like the ‘2% Rule’?

The 2% Rule (where monthly rent equals 2% of the property price) can be a useful quick filter. But it’s blunt. It ignores costs, taxes, and growth potential, and doesn’t suit all markets. Serious investors look beyond simple formulas to full financial analysis: cash flow, net yield, and long-term value. Rules of thumb are a starting point, not a strategy.

“While such rules can offer a preliminary check, they are no substitute for comprehensive financial analysis. A sophisticated investor looks at net operating income, cash-on-cash return, internal rate of return, and the long-term strategic fit of the asset. Relying solely on simplistic rules can be misleading.”

Final thoughts: Property Remains a Cornerstone in a Changing World

Even though things keep shifting around us, property still stands out as a solid investment. It offers steady income, the chance to grow your wealth over time, and a real, physical asset you can count on — qualities that many other investments can’t always match.

That said, succeeding in property today takes more than just buying and holding. It means being thoughtful, using good data, and having a clear plan for the long haul. Property isn’t about quick wins; it’s about building something that lasts through ups and downs.

At Alesco, we’re confident that with the right approach, property remains a key part of a balanced portfolio. It’s a way to secure resilient returns and protect your future.

If you want to see how property investment might fit into your financial goals, talk to one of our experts at Alesco Property.

“In a world that continues to present new challenges and opportunities, the fundamental strengths of property investment endure. With careful selection and strategic management, it remains a cornerstone for building and preserving wealth for generations to come.”

Written by: James Needham

Experienced Team Lead with a demonstrated history of working in the real estate industry.